Maximize Your Tax Savings.

We Handle Everything Else.

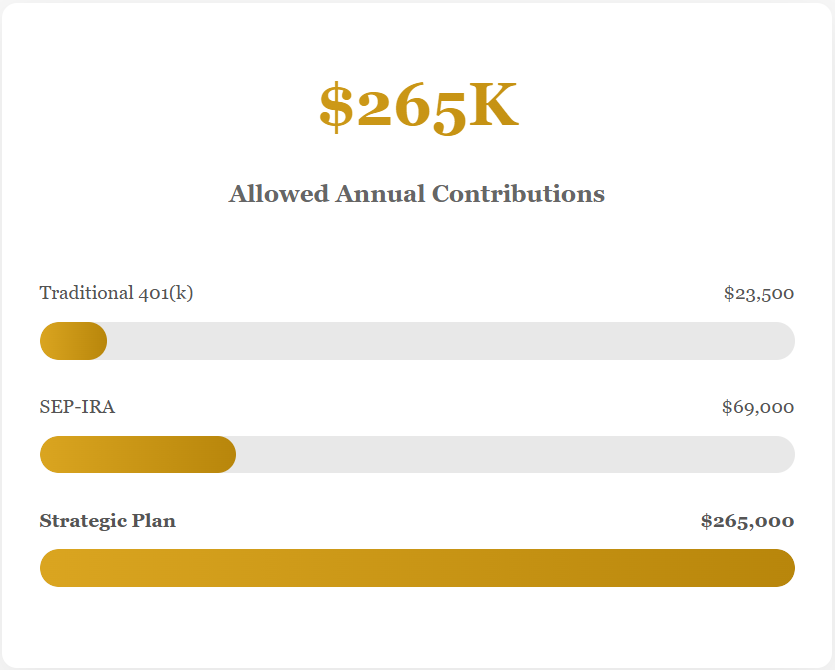

Traditional retirement accounts cap your contributions around 70K. Our retirement strategies can help business owners defer $200K to $300K+ annually, turning high-earning years into smarter tax years.

Built for Entrepreneurs Who Think Differently

IRS-compliant retirement solutions for business owners generating significant income who want more than one-size contribution limits.

Precision-Engineered Solutions

Every plan is built around your business model, cash flow patterns, and long-term objectives, aligned with how you actually operate.

Complete White-Glove Service

From actuarial calculations to annual filings, our team manages the technical requirements. You are not stuck chasing compliance forms or deadlines.

Measurable Tax Impact

Clients often defer $150K to $300K more annually than standard retirement vehicles allow. The tax savings alone can justify implementation.

When Standard Plans Stop Working

If you have already maxed a SEP-IRA or Solo 401(k) and still face a substantial tax burden, you may have outgrown conventional solutions.

Higher contribution limits, clean compliance

These structures are designed for business owners whose income has surpassed what traditional accounts can shelter. In the right scenario, contributions can reach $265K or more while maintaining full deductibility.

The result is lower taxable income during peak earning years and faster retirement accumulation, with ongoing requirements managed by our team.

The Cost of Waiting

Tax inefficiency compounds silently, and the opportunity cost adds up fast.

A $400K earner contributing $69K to a SEP-IRA instead of deferring $265K with a strategic plan may pay approximately $73K more in annual federal taxes. That money could have been compounding for decades.

Implementation Process

Simple on your side. Detailed on ours.

Financial Analysis

Share your business financials, income projections, and retirement timeline. Our initial assessment takes about 15 minutes and shows your estimated contribution capacity.

Strategy Development

We design your plan using actuarial modeling and tax optimization. You see projected contributions, tax savings, and costs before committing.

Activation

Once approved, we execute setup and ongoing compliance. You fund the plan based on cash flow. We handle everything else.

Discover Your Personalized Strategy

Answer a few quick questions about your business and income, and we will design a custom retirement plan aligned to your exact situation.

- See Your Exact Contribution Capacity

- Projected Tax Savings

- No Obligation

Pension Plan FAQs

Quick answers to the most common questions.

What income level makes this worthwhile?

Are these plans IRS-compliant?

What if my income fluctuates year to year?

What is involved after setup?

The most expensive advice is the advice you don't get. What you don't know you don't know can cost you millions over a career.